You Can’t Build a New Brand with Old Tools

by Jeremy Cochran

Brands aren’t just brands.

To be successful, brands today must represent much more than their products or services. They have to be heroes, best friends, counselors, teachers, and representatives. And in today’s hyper-competitive environment—defined by a constantly shifting global market and ubiquitous social media—consumers can abandon their long-established brand relationships at a moment’s notice. More than ever before, consumers’ expectations for individualized experiences set the tone, the pace, and direction for a brand’s voice and character. In a way, you might say consumers have taken control of brand marketing.

In this challenging landscape, what does a strong brand look like? And how do you measure it?

Traditional brand health models focus on awareness and performance, looking at how popular a brand is and how it performs in key areas. More recent models consider the unique challenges of the modern market, gauging a brand’s ability to make emotional and social connections with consumers. Specifically, Burke’s own brand health framework evolved to focus on how brands can deepen relationships with target consumers and foster more meaningful connections.

However, a substantial gap still exists between what brand tracking research delivers and what brand managers actually need to create effective marketing plans. Brand tracking programs work well for showing how the brand has done; marketers, however, need to know the best strategy for future growth.

In other words, marketers don’t just need to know where brands have been—they need to know where the brand is going.

At Burke, we have seen evidence of this gap first-hand. As consultants, we have observed changes in the questions our clients and their stakeholders ask us: How will the market change? What should we do about it? Who will take our share? How will our customers’ expectations change and how can we meet their needs? What should we do differently?

Questions like these speak to concerns about the future, defined by the uncertainties of a shifting present. And to provide answers, researchers need models and insights systems that help brand leaders address the challenges of the present also while looking beyond the here and now.

Bringing Insights and Strategy Together at the Ground Floor

Any new framework that aims to help brands navigate today’s challenging environment must incorporate both traditional market research and brand strategy perspectives. While researchers have the expertise to develop new metrics and uncover connections, strategists understand how brand managers and marketing teams think, process information, and make decisions. A purely research-focused framework could lack relevance to the realities of marketing decision-making, while a purely strategy-focused framework may miss out on connections that can be found through analysis.

Our goal was to develop validated, relevant metrics that research teams could use to provide predictive insights to brand managers—namely, what would define success in the future, given the changing competitive landscape. To achieve this, we crafted a “north star” philosophy that centered on two critical pillars of brand strength:

First, brands need to be relevant. That means maintaining a consistent presence in consumers’ minds, understanding and meeting consumer needs, and differentiating from other, similar brands.

Second, brands must compete with momentum. That means brands must show consistent forward movement, while demonstrating vitality and growth potential.

Together, Relevance and Momentum define a brand’s overall strength. In addition, mapping a brand’s market position—as well as that of competitors— provides context, based on relevance and momentum, which can be instrumental in helping set strategy for future success.

Relevance: Still the Heart of the Matter

At its core, a strong brand is one that has formed connections with potential users. While there is debate about how close and enduring those connections need to be, strong brands are the ones that consumers can easily recognize, have at least some kinship with, and see as different from others. In short, strong brands stand out because they stay Relevant.

This element of brand strength is nothing new. Brands spend millions on increasing awareness, crafting an identity consumers can connect with, and distinguishing themselves from competitors. Broadening and strengthening relationships with consumers remains a core element of brand growth, even in the modern environment.

Relevance is comprised of three dimensions:

PRESENCE. Simply put, brands cannot grow if they’re not known among potential users. Presence stems primarily from elements captured in traditional funnel metrics (i.e., awareness, consideration, and purchase). These measures still represent the primary means by which consumers interact with brands. Top brands like Facebook, Wal-Mart, and Coca-Cola have a strong presence among consumers they can leverage to strengthen their identity.

DISTINCTION. Distinctive brands drive a sense of differentiation and demand a higher price point. Brands that stand out from the crowd (in a good way) will have an easier time growing. For example, distinctive brands like Apple and Mercedes-Benz elicit a different type of attention than brands that are seen as more interchangeable.

AFFINITY. Relevance is not just about being known and recognized. It’s about fostering a strong sense of connection—or Affinity—with consumers. In other words, the more consumers feel they identify with (and can rely upon) a brand, the more likely that brand is to endure and flourish. While users don’t need to profess blind loyalty to a brand, closer relationships between consumers and brands signify a stronger, more enduring position in the market. Visa, Marriott, and Oral B are examples of brands that demonstrate high Affinity—they convey a sense of trust and empathy that helps consumers feel understood.

Momentum: Fuel for Growth

Most traditional brand health models stop at Relevance, with the underlying assumption that strengthening existing relationships with consumers will lead to growth. In a world where success was solely defined by a brand’s image and product quality—this would be fine. But, as mentioned before, expectations for brands have multiplied. Consumers now expect brands to evolve, push boundaries, and influence society beyond just their products. Brands that are not moving forward (or try to resist change) are soon seen as stale, out of touch, and may be outshone by newer or more dynamic competitors. In short, strong brands stay strong because they compete with Momentum.

Momentum is comprised of two key dimensions:

VIBRANCY. Vibrant brands demonstrate ingenuity and agility. They never rest on their laurels. They’re always innovating new products, new features, or new ways of connecting with their users. Consumers can quickly turn on brands that give even a hint of entitlement, especially in a time of rising prices and increasing pressures on buying power. By contrast, brands that demonstrate their commitment to continuous renovation, reimagining, and reconnecting will propel themselves forward. Vibrant brands like T-Mobile, Venmo, and TikTok give consumers the sense that there’s always something new around the corner.

ADVOCACY. Along with a focus on the future, brands also must look beyond their business into the world around them. Consumers expect brands to act as corporate citizens and Advocate for causes that align with their values. While many brands would likely prefer to steer clear of controversial issues, consumers recognize the financial and cultural power that large brands—and their parent companies—hold; thus, they often demand recognition and action when it comes to certain issues. Additionally, brands can lean into their Advocacy, incorporating their passion for causes as part of their brand messaging.

Brands that have a clear environmental purpose (such as Tesla, with electric vehicles) or that have aligned with social movements (such as Nike’s provocative advertisements with Colin Kaepernick) demonstrate their leadership in the modern brand environment. While taking an active stance on issues can be risky, brands that ignore or detach themselves from issues risk alienating consumers and losing momentum.

Metrics That Connect

Our Relevance + Momentum framework was developed after months of research and development. After conducting a literature review, referencing established brand models, and brainstorming a range of potential approaches with our experts, we reduced these down to an initial framework. We vetted and validated this framework via primary research, then formulated associations between key brand measures and business-outcome metrics, which included financials and social media presence.

Our final framework shows a strong, significant relationship between Brand Strength and financial strength, as well as social media strength. In addition, we found that Relevance and Momentum connect to inform different elements of brand success: higher Relevance connects to current success (such as revenue, EBITDA, and followers), while brands with higher Momentum are more likely to have shown recent growth.

A Map to Success

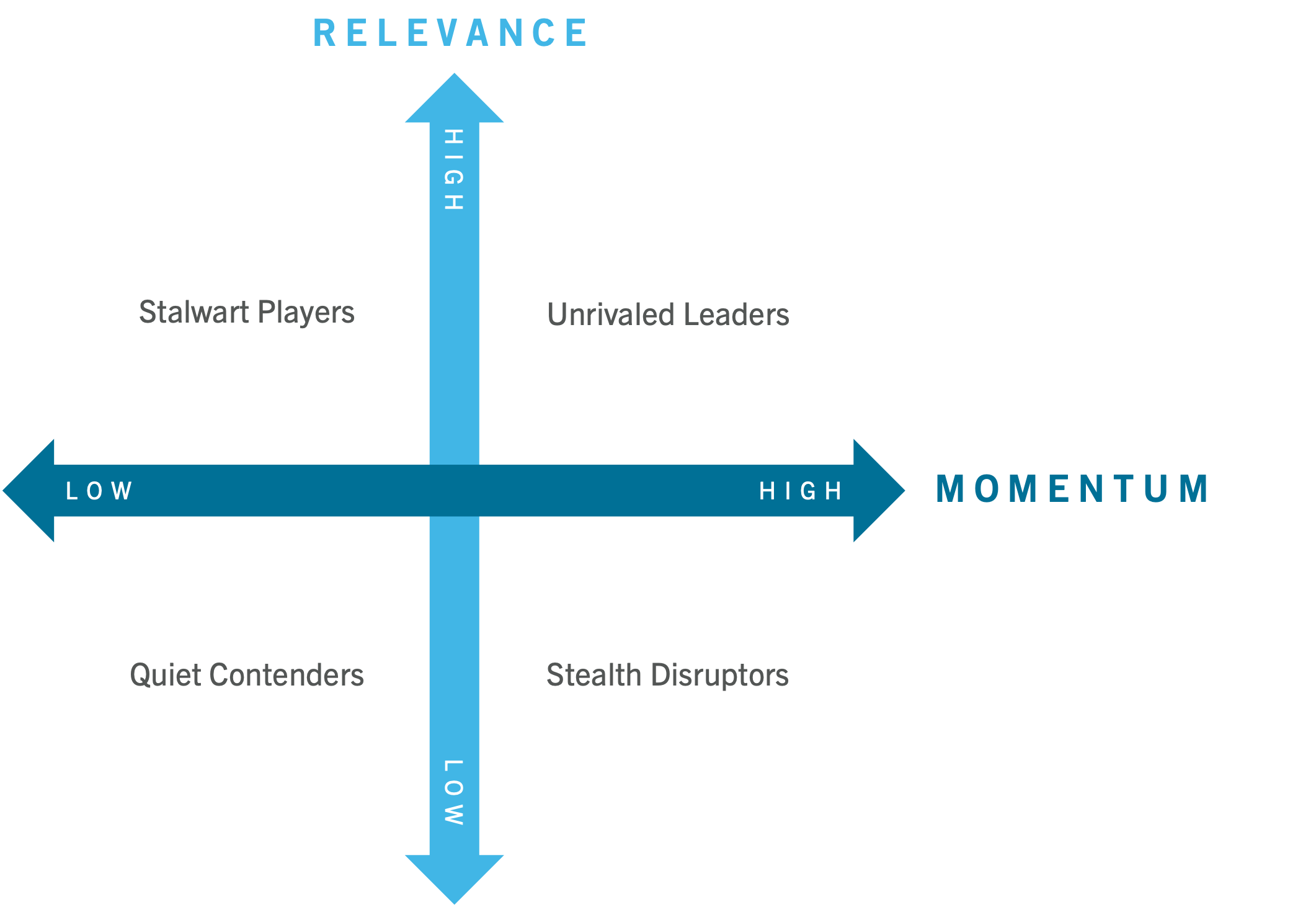

Viewing Brand Strength as the intersection of Relevance and Momentum also enables mapping the market landscape for a product category along two axes, where X represents Relevance and Y represents Momentum. The resulting quadrants represent four “market archetypes” that describe a brand’s position in their given market:

- Unrivaled Leaders. Brands with high Relevance and Momentum have a strong influence on the marketplace that will likely endure. Brands in this quadrant can focus on maintaining their position while keeping the momentum that sets them apart from the competition. Apple is a clear example of an Unrivaled Leader in the Personal Technology category.

- Stalwart Players. Brands with high Relevance but lower Momentum are well-known players in the market but may be seen as less engaged or energetic than certain competitors. Brands in this quadrant may have relative security and should focus on maintaining their brand identity. Yet, they risk losing interest from consumers without new energy. In our research, Facebook is a strong example of a Stalwart Player, given its strong market position but less vibrant reputation.

- Stealth Disrupters. Brands with lower Relevance but higher Momentum project an entrepreneurial vibe that resonates with consumers but has yet to widen (or deepen) their relationships with consumers. Brands in this area should identify how they can utilize the buzz around them to broaden their market base and create a stronger reason to buy. With its reputation for innovation and growth while not yet a mainstream presence in the market, Tesla is an example of a Stealth Disrupter in the Auto industry.

- Quiet Contenders. Brands with lower Relevance and Momentum are recognized by consumers but have less of an influence on the market. While brands aren’t likely to be comfortable here overall, there are benefits to being a smaller player: brands in this quadrant generally don’t have a strong identity in the market (yet), so they have the chance to craft a new story. An example from our research is Dollar General—while a top name in the discount retail space, Dollar General is a Quiet Contender when compared to other large retailers such as Target, Amazon, and Walmart.

While most brands would prefer to be an Unrivaled Leader in every category, the implication of being in any quadrant comes down to whether a brand’s placement aligns with its strategy for the category. A brand could be an Unrivaled Leader in its primary category, but a Quiet Contender in an ancillary category, based on its marketing strategy.

At the end of the day, this fresh evolution of brand performance monitoring can help close the gap between what marketers need (a way to measure what matters to them today) and what researchers can provide (a strong metric that helps give strategic direction). Developed by both researchers and strategists, this Relevance + Momentum framework provides a simple yet effective option for assessing a brand’s position in the market and activating solutions to improve that position.

For more information on Burke’s Brand Strength Monitor and how it can help move your business forward, visit www.burke.com/brandstrength. And, click the image below to listen to a deeper dive into this topic on our podcast!

Jeremy is Burke’s Research and Development Manager. As an analytics and strategy leader with over 15 years of experience in the insights industry, Jeremy has a passion for finding new ways to solve problems and gain insights.

A version of this article was published on Quirk’s Media. To view the article, click here.

Interested in reading more? Check out more from Jeremy:

Key Takeaways from IIEX North American 2023

Healthcare Innovation: Current Challenges and Future Outlook

Making it Right: The Importance of Issue Resolution to E-Commerce Consumers

Digital Healthcare Tools & Data Security: Are Consumers Concerned?

As always, you can follow Burke, Inc. on our LinkedIn, Twitter, Facebook and Instagram pages.

Source: Feature Image – ©Drazen – stock.adobe.com