Inflation’s Impact on Consumers:

How Rising Prices Have Redefined The Splurge Purchase

by Jeremy Cochran, PsyD

Splurging and Inflation

Inflation has redefined how U.S. consumers think about necessary and discretionary purchases. Over the past four years, rising prices across almost all sectors have altered consumer habits, forcing them to be more selective about where they spend their discretionary income.

With rising prices, what constitutes a “splurge” purchase has shifted in the last several years. Understanding this shift and inflation’s impact on consumers is crucial for insights professionals, marketers, strategists, and brand managers who want to resonate with consumers and earn some of their limited discretionary income.

Early Inflation and Spending Choices

The 2020s has brought inflation to the forefront of consumers’ minds in a way not seen since the stagflation crisis in the late 1970s to early 80s. Starting in early 2021 US inflation rates rose to a peak of 9.1% in June 2022, coming down slowly since and hovering around 3% in 2024.1 While inflation has cooled since the peak, prices haven’t gone down and the cost of most goods increased by 31% in that time.2

Inflation was highest in necessary expenses: food, gas, housing, and utilities, among others. It’s no surprise that consumer confidence declined sharply between 2021 and 2022 and remained tepid ever since. Consumers felt betrayed by the sharp increases, especially coming right after extended COVID lockdowns when so many products were unavailable.

To counter the rise in costs for necessities, consumers have had to rethink how they perceive of common and discretionary purchases and how best to manage their budget. Primarily, consumers started trading down, but as inflation’s impact on consumers persisted, broader behaviors started to change; these included less frequent purchases, shifting from restaurants to eating in, and more acceptance of value-based brands. 2022 saw huge declines in spend on personal care, clothing, home furnishings, and restaurants3 More and more of consumers’ budgets were going towards essentials, leaving fewer dollars for discretionary purchases.

Yet unlike previous times of inflation, some discretionary categories remained strong despite their rising costs. Travel purchases remained high through the 2022 and 2023 seasons as consumers exacted “revenge travel” after COVID lockdowns. The same phenomenon occurred with concerts, movies, and other entertainment events – anything related to social experiences continued to be a priority for consumers. After months of being able to shop for goods only online, consumers were ready to forgo those goods and spend their discretionary funds on experiences.

As the economy stabilized in 2023 and 2024, consumers became somewhat more confident in their personal finances (though less confident in the economy in general). Yet given the impact of inflation on prices, consumers were still splurging at a more modest level.4

Why Did Splurging Continue? The Lipstick Index

The desire for consumers to treat themselves is strong, even in the face of the economic challenges. Historically, in times of recession or otherwise lower consumer purchasing power, splurge purchases shift from large-scale luxuries to more “affordable luxuries,” like cosmetics, small entertainment (movies), or gadgets. This phenomenon is known as the “lipstick index,” so-called after Leonard Lauder, chair of Estee Lauder, noticed in 2001 that sales of lipstick (and other cosmetics) increased as the broader economy weakened.

Lauder’s observation reflected the tendency of consumers, in times of economic trouble when bigger items are out of reach, to buy small comfort or escapist purchases more often. While the lipstick index is far from a solid economic theory, it did apply in the post-COVID inflationary period as sales of cosmetics —specifically, skin care products—surged.5

Splurging Now – Still Going Small

As inflation’s impact on consumers has cooled over the last year and a half, consumers are adjusting to the new reality of prices and settling into adjusted spending habits, including whether, when, and how to splurge. About 40% of US consumers said they intended to splurge sometime in both Q4 2024 and Q1 2025, particularly on high-priority categories like fashion, personal technology, and experience-based purchases.6

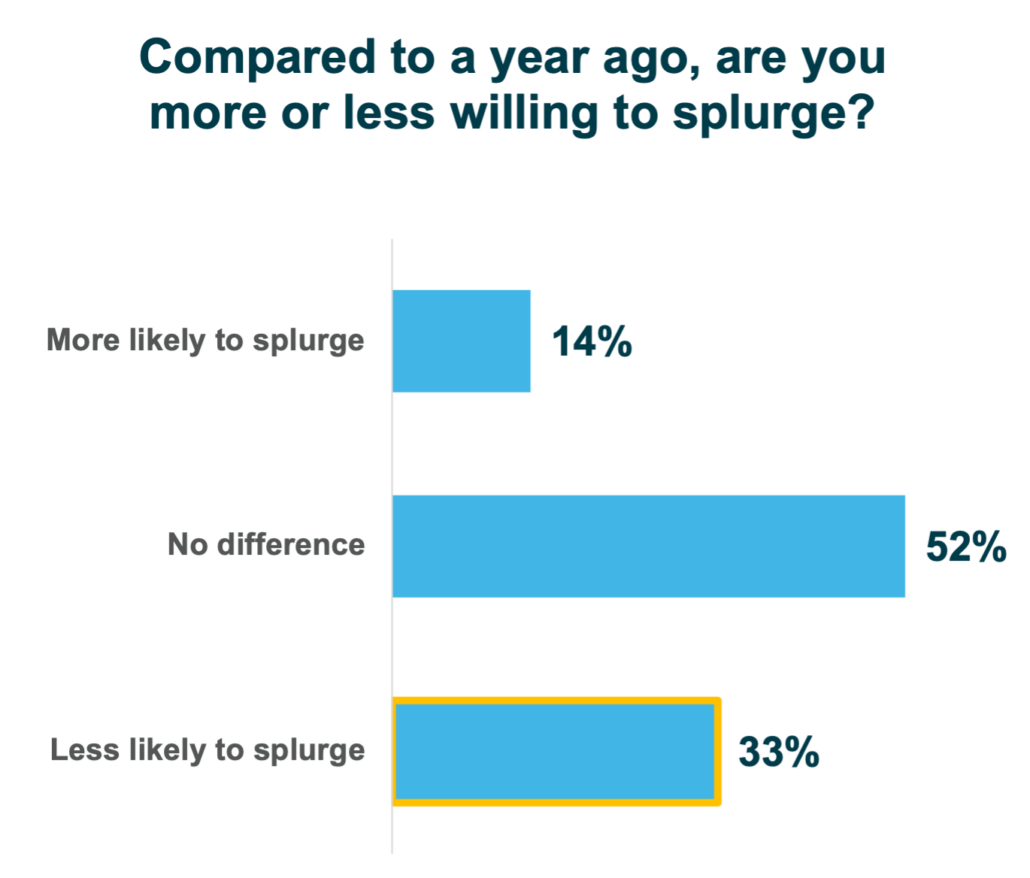

Recently7, we asked US consumers about their splurge purchasing and how it has changed over the past year. Unsurprisingly, Burke’s research found that consumers are now rarely splurging. Over half of consumers say they only splurge twice a year or less, with over a quarter saying they splurge less than once a year. And the impulse to splurge has yet to recover with inflation easing, as only 14% of consumers say they feel more willing to splurge compared to last year, and a third of consumers saying that they are less likely to splurge.

Source: Burke Omnibus Program, Sept-Nov 2024. n=1800

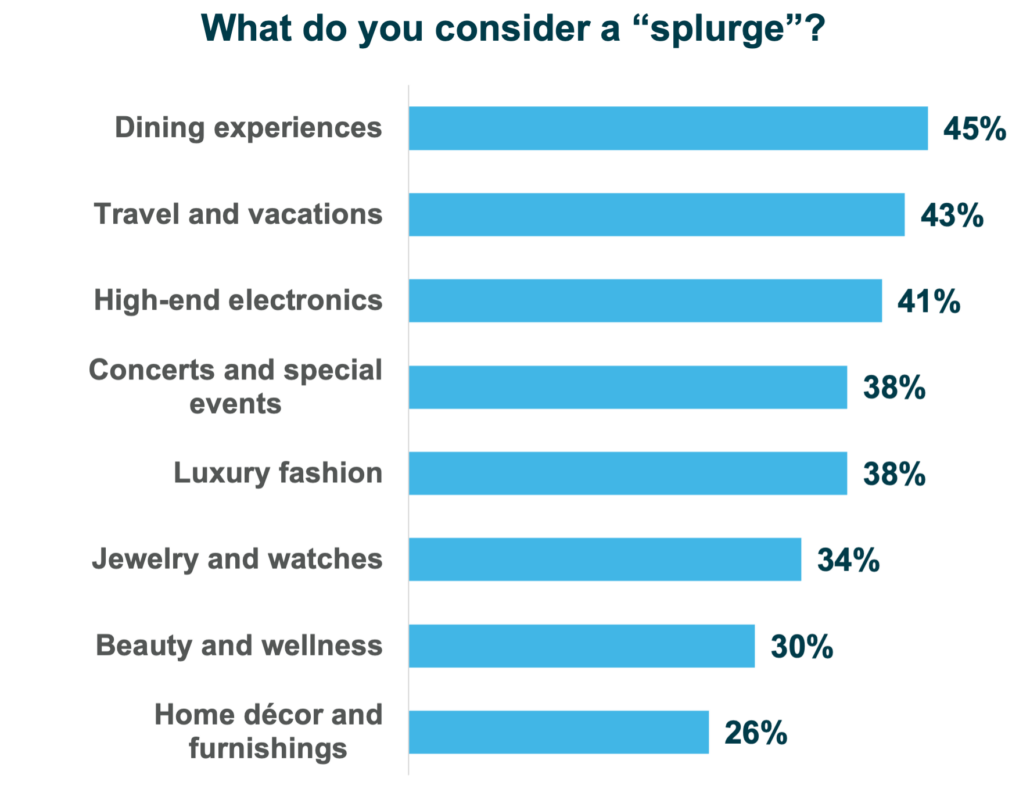

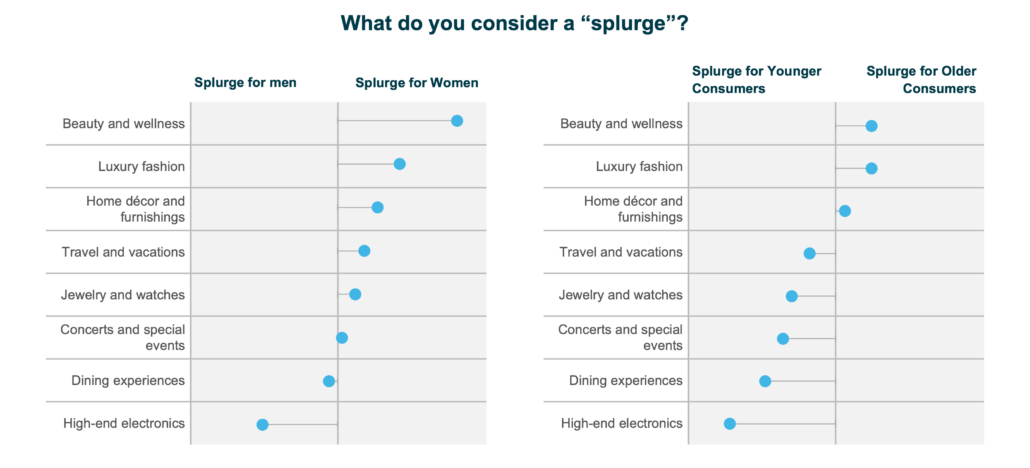

What does a splurge look like? For most consumers, food and travel make up the top splurge purchases, followed by high-end electronics. However, splurges aren’t the same for everyone. Tech devices are the most popular splurge among men, while beauty, fashion, and home décor are more frequent splurges for women. Travel as a splurge is most apparent in higher-income consumers; given the increasing costs for travel over the last few years, it’s not surprising that interest in travel as a splurge purchase is directly related to income levels.

Source: Burke Omnibus Program, Sept-Nov 2024. n=1800

Source: Burke Omnibus Program, Sept-Nov 2024. n=1800

Splurging Shift

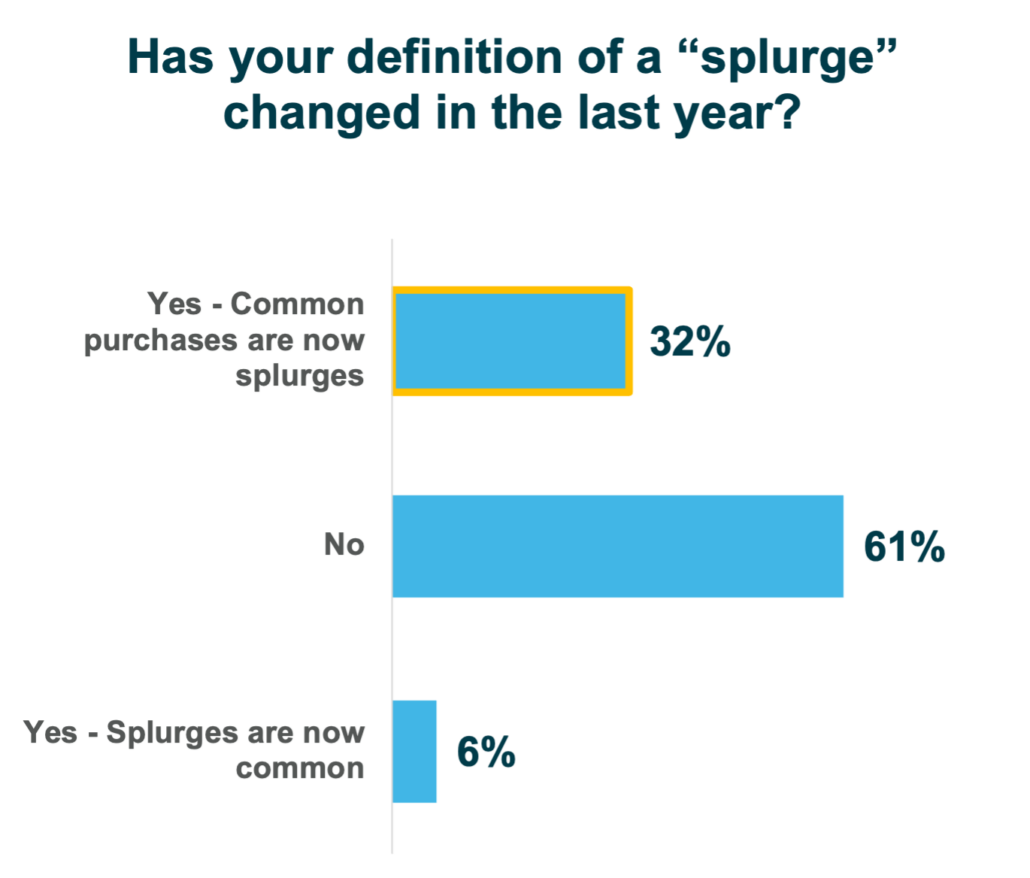

For some consumers, however, what defines a splurge purchase has changed in recent years. Nearly a third of our respondents said that purchases that were once common are now splurges; this rises to nearly 40% for Gen Z and Millennial consumers as these groups likely had less financial cushion to absorb the shock of inflation’s impact. It is worth noting that 61% of consumers said their definition had not changed, which suggests that spending patterns have become more consistent as inflation has eased.

Source: Burke Omnibus Program, Sept-Nov 2024. n=1800

Among those who say that more common purchases have become splurges, food and apparel emerge as the top categories that have fallen out of reach. With food, consumers lament that more “everyday indulgence” eating occasions, such as getting takeout or pizza delivery, have now become splurges. And consumers don’t just miss the actual food but the experience that food brings, such as dinner or coffee dates.

“Ordering a pizza for delivery was common but is now a splurge because we have less money to make the purchase.”

“Dinner at a nice restaurant with family. Coffee dates with friends. Everything is so expensive.”

For clothes, consumers say that they can no longer buy clothes or brands that interest them but must consider their budget for any purchase. This further creates a sense of betrayal for consumers as more and more elements of the shopping experience are taken away from them.

“[Something that wasn’t a splurge before but is one now is] buying an article of clothing I really like. I don’t buy [something like that] now where before I would’ve purchased it if it wasn’t an outlandish expense.”

Holiday Spending – Splurging for Others is Okay

While personal splurge purchasing has shifted towards more approachable luxuries, consumers have not pulled back much when it comes to splurging for others during the holiday shopping season. Despite price increases, holiday sales from November through Christmas Eve 2024 increased 3.8% from 2023, an even larger increase than seen a year earlier.8 Consumers spent on average $900 and $1,100 on holiday gifts for 2024, again increasing from previous years.910 Clothing, electronics, and toys topped the list of holiday gifts while experiences and travel-related gifts were at the bottom, the opposite of self-splurge purchases.11

Increased spending in the holiday season in a “post-inflation” environment could reasonably be considered splurging, but it’s not a sign that consumers are feeling more comfortable spending (especially since many are taking on credit card debt or using buy now, pay later services for these purchases). Holiday splurging is in a different category psychologically than self-splurges – for US consumers, the pressure to find perfect gifts, bring joy to others, take advantage of holiday sales, and re-create the nostalgic happiness of holidays in their childhood makes splurging a lot easier.12

How to Position Splurge Brands in Hard Times

In inflationary or post-inflationary times, in can be difficult for brands to balance the realities of the market with meeting their consumers’ needs. This is especially true for discretionary brands that must remain appealing enough to warrant a higher price point while retaining a level of empathy for its consumer base. In these situations, it is tempting to think that a brand’s marketing and positioning loses importance to pricing strategies aimed at managing price sensitivity. But marketing experts agree that a brand’s strength is even more important during economically difficult times.13

The primary goal of brand marketing during these times is to communicate the value of the brand to the consumer even if the price point itself is increasing. Consumers need to know that the brand they are purchasing is giving them the most value for their money, even if that value is in entertainment, indulgence, status, or other psychological rewards associated with splurging. Persuading consumers of a brand’s value can come in different forms, including highlighting a brand’s trustworthiness, strengthening the brand’s emotional connection with consumers, and/or showing true empathy towards consumers’ situations. Each of these strategies helps reassure consumers that their splurge purchase is worthwhile and deserved.14

Splurging beyond 2025

As we move past 2024, the definition of splurging will depend highly on the continued decrease in inflation’s impact on consumers as well as overall consumer sentiment. Given the length of time needed to adjust to higher prices, consumers are likely to continue focusing their discretionary dollars on small indulgences (food, skin care) or affordable experiences (travel, wellness). Brands looking to capture these discretionary dollars should emphasize the comfort their products bring, how their product will provide benefits over time, or the memorability of their experience to best frame their brand as providing the best value.

Psychologically, it also benefits brands to emphasize the comfort their product might bring as a splurge as well as the connection to other people. Given the current chaotic news cycle, consumers are likely to be drawn to indulgences that bring them joy or comfort and help them feel part of a broader community. Beauty, fashion, and home décor categories can emphasize the continuing joy of aesthetic beauty, while travel, dining, and even high-end electronics can focus messaging on connecting with people both new and familiar.

The recent introduction of tariffs to other countries is also likely to have an outsized impact on splurging behavior. Given the indiscriminate nature of the recent tariffs, it is hard to know what products will and will not have their costs impacted or how much of the costs companies will pass on to consumers. But with any increase in the cost of living and general instability in the economy, consumers will continue to want small comforts to give them a feeling of control.

In the end, splurging is something consumers want to do to give themselves a bit of joy and a sense of control in their lives. That desire doesn’t leave when purchasing power declines, it just adapts to the circumstances. Brands can continue to reach consumers wanting to splurge during tough times, but they must approach their messaging with compassion, understanding, and acute awareness of what consumers most want from their splurge.

Jeremy is Burke’s Research and Development Manager. As an analytics and strategy leader with over 15 years of experience in the insights industry, Jeremy has a passion for finding new ways to solve problems and gain insights.

Interested in reading more? Check out Jeremy’s other articles:

Disrupt Consumer Decision-Making to Realize Growth

Reflections for Success in 2025

As always, you can follow Burke, Inc. on our LinkedIn, Twitter, Facebook and Instagram pages.

Sources:

1 US Inflation Calculator. (2025). Current US inflation rates: 2000-2025. Retrieved from https://www.usinflationcalculator.com/inflation/current-inflation-rates/

2 NielsenIQ. (2024). 2024 Consumer outlook summary presentation. Retrieved from https://nielseniq.com/wp-content/uploads/sites/4/2024/02/2024-NIQ-Global-ConsumerOutlook-SummaryPresentation-2.pdf

3 Rogers, S., Waelter, A., & Pieters, L. (2024). Inflation’s impact on financial well-being. Deloitte. Retrieved from https://www2.deloitte.com/us/en/insights/industry/retail-distribution/consumer-behavior-trends-state-of-the-consumer-tracker/inflation-financial-wellbeing-consumer-spending-habits.html

4 Coggins, B., Adams, C., & Alldredge, K. (2024). The state of the US consumer. McKinsey & Company. Retrieved from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-state-of-the-us-consumer-2024

5 Fox, M., & Jensen, L. (2022, November 22). The lipstick index is back. The Wall Street Journal. Retrieved from https://www.wsj.com/articles/the-lipstick-index-is-back-11669256641

6 Sheehan, E., Stephens, B., Bamford, R., Rogers, S., & Cook, J. (2023, April 27). Understanding splurge spending. Deloitte. Retrieved from https://www2.deloitte.com/us/en/insights/industry/retail-distribution/consumer-behavior-trends-state-of-the-consumer-tracker/splurge-spending-inflation-lipstick-index.html

7 Burke Omnibus Tracking Program. (September, 2024). Consumer Perceptions of “Splurge” Purchasing.

8 Zahn, M., & Meyer, M. (2024, December 26). Holiday spending surges, flexing strength of US economy. Associated Press. Retrieved from https://apnews.com/article/holiday-spending-mastercard-0e11efb764f5ff0ad84ddb4505e17398

9 Shay, M., & Kleinhenz, J. (2024, October 15). Steady sales growth expected for 2024 holiday season. National Retail Federation. Retrieved from https://nrf.com/media-center/press-releases/steady-sales-growth-expected-2024-holiday-season-according-nrf

10 Jones, D., & Smith, A. (2024, October 25). Consumers plan generous holiday spending. Gallup. Retrieved from https://news.gallup.com/poll/652664/consumers-plan-generous-holiday-spending.aspx

11 Davis, M., & Shepard, D. (2024, December 23). 36% of Americans took on holiday debt, averaging $1,181. LendingTree. Retrieved from https://www.lendingtree.com/credit-cards/study/holiday-season-debt/

12 GOBankingRates. Retrieved from https://www.gobankingrates.com/saving-money/holiday/why-do-we-spend-so-much-each-year-on-holiday-shopping/

13 Smith, J., & Lee, R. (2022, March 11). As inflation accelerates, marketers need to respond with consideration. The Conference Board. Retrieved from https://www.conference-board.org/topics/geopolitics/as-inflation-accelerates-marketers-need-to-respond-with-consideration

14 Mendoza, J., & Lee, S. (2024, March 22). 5 strategies to create inflation-proof marketing campaigns. Forbes. Retrieved from https://www.forbes.com/sites/jessicamendoza1/2024/03/22/5-strategies-to-create-inflation-proof-marketing-campaigns/

Feature Image – ©AnnaStills – stock.adobe.com